Tag Archive for: Automotive Aftermarket and Auto Parts Market

The New Definitive Guide to Automotive Content Marketing

Auto Parts MarketingAutomotive content marketing is about creating engaging, relevant, high-quality content, and using that content to connect you with existing and potential new customers. It's an important strategy because it builds brand awareness, establishes your credibility, brings in web traffic, and ...

Characteristics of Automotive DIY Consumers

Automotive Market ResearchWe analyze buying behavior of automotive maintenance DIYers, by digging into a recent survey published by the Auto Care Association with data from Hanover Research. The automotive DIY market is ...

Average Age of Cars On The Road

Automotive Market ResearchHow old are cars on average? We get asked from time to time how old are cars and what's the average age of vehicles on the road? Let's dig in! Scroll down to see some original analysis you won't find anywhere else on the internet!

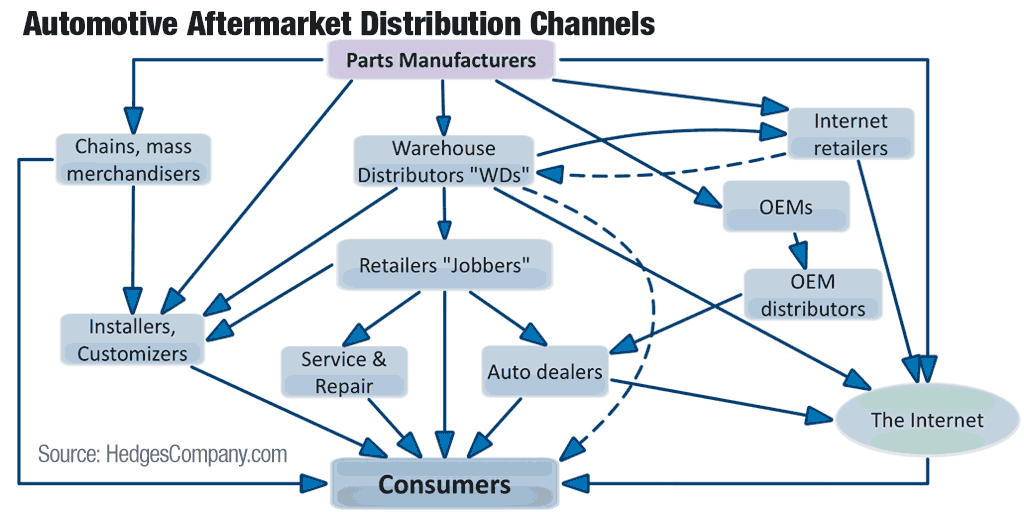

What is The Automotive Aftermarket? How Many Car Enthusiasts Are There?

Auto Aftermarket News & Trends, Automotive Market ResearchWhat is the automotive aftermarket? It is unique among industries and we've compiled some compelling reasons to say that. In this article are some specific things that define the automotive aftermarket and what makes the aftermarket unique among industries in the ...

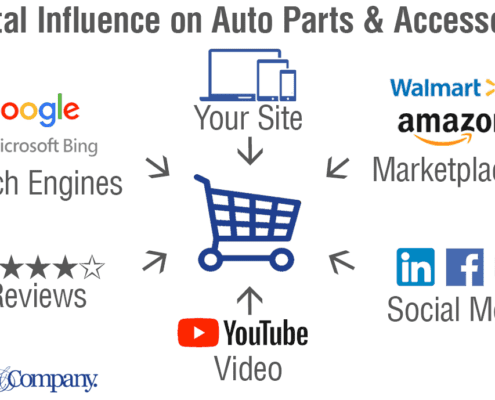

Digital Influence on Auto Parts, Accessories and Replacement Tires

Auto Aftermarket News & Trends, Automotive Market Research

Digital influence on the automotive parts & accessories market will be at $177 billion in 2023 in the US. It's projected at $200 billion in 2026 and $217.8 billion by 2028.

Note: scroll down to download a PDF of this article, no registration…

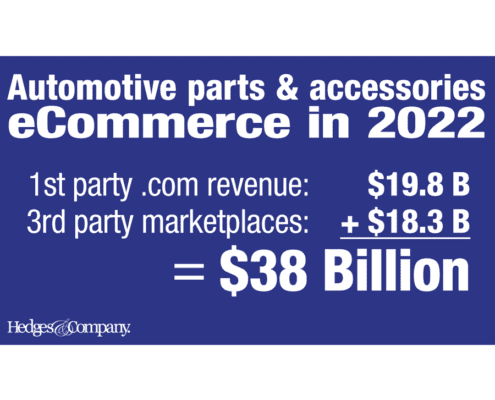

Auto Parts Industry Growth: eCommerce at $67 Billion by 2030

Auto Aftermarket News & Trends, Automotive Market ResearchAuto parts industry growth: 9% eCommerce growth rate through 2025

Compounded annual growth rate (CAGR) for parts eCommerce is projected just under 9% through 2025. Online revenue for automotive parts eCommerce revenue will reach $41 billion…

Types of Google Searches for Auto Parts and Accessories

Auto Aftermarket News & TrendsWhen marketing an automotive parts or accessories website, it’s important to understand the different types of Google searches, how search intent matters, and how consumers use...

Automotive Industry Future Outlook: 2021-2024

Auto Aftermarket News & TrendsThe COVID-19 pandemic has changed the future of the automotive industry. We show the current situation and the future of the automotive industry, in just seven charts.

We'll start by showing you the current impact of the pandemic on the auto…

Auto Parts eCommerce Market Share At $16 Billion in 2020

Auto Aftermarket News & Trends, Auto Parts Marketing, Automotive Market Research

Auto parts eCommerce market share: transformational shift in 2020-2021

Note: Here's a link to a more recent article on auto parts industry growth and eCommerce projections.

Trends in online shopping: automotive parts eCommerce revenue…

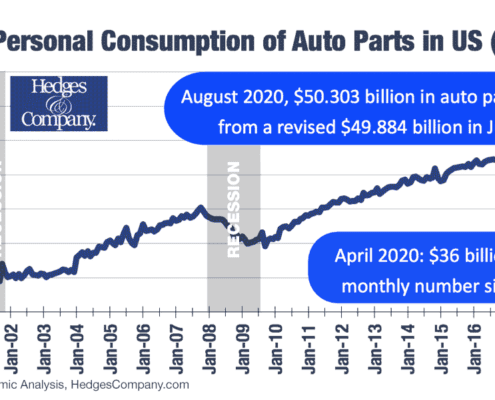

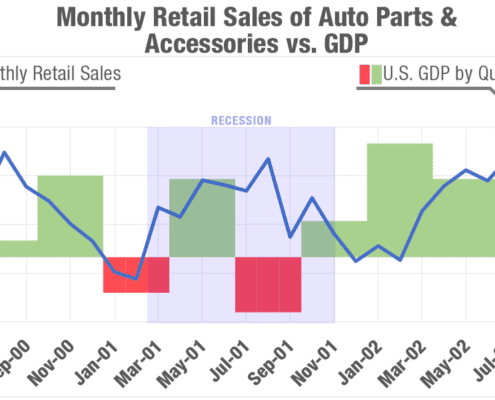

Coronavirus impact on the amazing automotive aftermarket: Recessions, stock market crashes, unemployment

Auto Aftermarket News & Trends

What's the coronavirus impact on the auto aftermarket?

What is the COVID-19 and coronavirus impact on the auto aftermarket? Most economists seem to agree right now that we're probably heading into a recession. (This is written March 27, 2020.)…

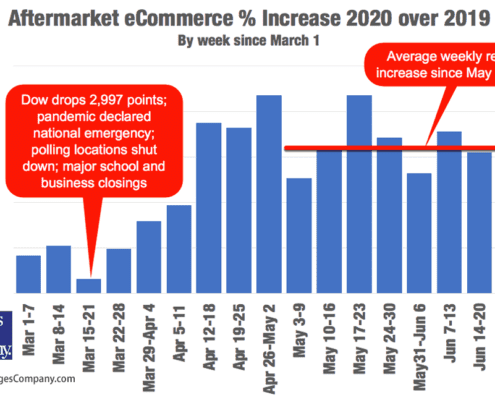

Updated 7/28/20: Coronavirus and Automotive Aftermarket eCommerce News

Auto Aftermarket News & Trends, Auto Parts Marketing, Automotive Market Research

Note: See related article, click here: Auto parts chain store sales trends.

Aftermarket eCommerce maintaining big increase from 2019

(July 28) Data shows the aftermarket eCommerce channel has a significant year-over-year (YoY) revenue…

Conversion Rate Analysis of Automotive Sites

Auto Aftermarket News & Trends, Auto Parts MarketingFree website conversion tool for your automotive website

After extensive research and conversion rate analysis, we built a free website conversion tool you can use to measure or predict your own conversion rate.

Our conversion rate experts…