Auto Parts eCommerce Market Share At $16 Billion in 2020

Note: Here’s a link to a more recent article on auto parts industry growth and eCommerce projections.

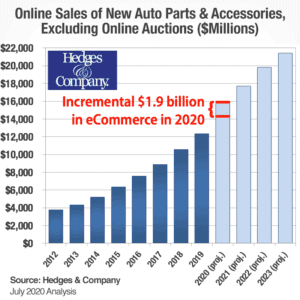

Trends in online shopping: automotive parts eCommerce revenue hit $16 billion in 2020 in the US. Auto parts eCommerce market share is projected at over $22 billion by 2023.

CLICK TO ENLARGE: There has been a fundamental shift in the auto parts eCommerce industry. The coronavirus shutdown shifted $1.9 billion in incremental revenue to the eCommerce channel in 2020.

• Incremental $1.9B above original forecast in eCommerce channel in 2020.

• North American new auto parts eCommerce market share nearly $20B in 2020.

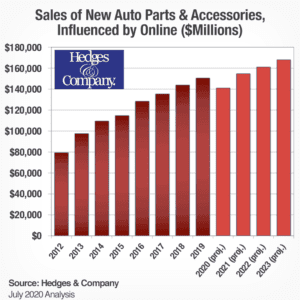

• Digital impact: $141B in parts revenue influenced by online; $169B in 2023.

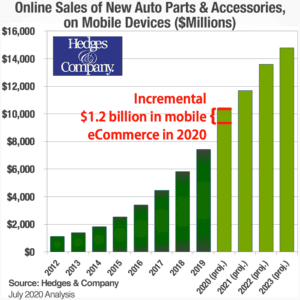

• Over $10B in online parts revenue was on mobile in 2020.

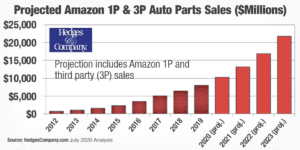

• Amazon eCommerce platform passed $10B in in 2020.

It’s hard to overstate the dramatic change in automotive eCommerce market share due to the coronavirus pandemic. Across the country in 2020, retail businesses shut down or limited customer due to COVID-19. Trends in online shopping are still accelerating in 2021 with consumers buying online at an unprecedented rate. In our annual eCommerce market share analysis, nearly $2 billion in additional revenue shifted to the eCommerce sales channel in 2020. It exceeded $16 billion, a huge 30% increase over 2019.

Trends, online shopping: #Autoparts #eCommerce market share passed $16 billion in 2020, up 30% from 2019. There's a $2 billion incremental shift in 2020 due to COVID19. #DrivePartsSales Click To TweetWe estimate that automotive aftermarket eCommerce market share in Canada reached CA$4.9 billion/US$3.7 billion in 2020. Online parts revenue in Mexico came in around US$903 million. That puts the North American automotive eCommerce market size at US$20.6 billion in 2020.

In the US, eCommerce revenue was originally projected at around $14.1 billion in 2020. Nearly any industry had a dramatic shift to eCommerce this year due to COVID-19. The auto parts industry is no exception. An incremental $1.9 billion in revenue shifted to auto parts industry eCommerce, above the original forecast, in 2020 alone.

Auto parts industry: Digital affects all retail

Digital influence has a huge impact on the auto parts retail industry. Just over $140 billion in the auto parts retail industry in the US was influenced by digital in 2020. That includes online and offline revenue. It includes revenue through sales channels like brick and mortar retail like chain stores or independent auto parts retailers.Trends, online shopping: the power of Digital Influence: $140B in #autoparts revenue in retail in the US was influenced by digital in 2020. #DrivePartsSales Click To Tweet

First, what is the definition of “digital influence?”

This influence is what affects a consumer doing online research before buying an auto part or accessory. More than nine out of 10 shoppers do online research even if planning to buy in a retail store. This influence also comes from online advertising, reviews, “how-to” content, video ads and video content.

Digital impacts $140 billion in auto parts retail

CLICK TO ENLARGE: Digital influence impacts $140 billion in auto parts and accessories revenue in 2020.

Auto parts shoppers do a lot of online research. They look at reviews or watch video on YouTube. They verify parts fitment on retailer websites and manufacturer websites. Consumers read automotive forums, or conduct long tail searches on Google or Bing.

More than nine out of 10 consumers do pre-purchase research online. Hedges & Company consumer survey data shows this online research is concentrated in four areas: Consumers use online search (74% of all parts and accessories consumers); they look at auto parts retailer websites (73%); manufacturer websites (57%) and automotive forums (47%).

We projected a drop in digital influence in 2020. That’s because a significant portion of auto parts retail industry revenue comes from traditional retail channels. These channels include auto parts chain stores, independent retailers, service repair shops, big box stores and other auto parts retailers. Revenue through these retail channels is projected to be down from 2019.

We expect 2021 to rebound ahead of 2019. By 2023, digital influence on parts and accessory sales will increase to over $168 billion in parts and accessory sales.

Auto parts revenue through some retail channels has minimal impact from digital influence. Service repair shops are an example of this. Consumers don’t have as much awareness of auto parts brands if a repair shop recommends a part. In some cases the brand of a part may not even be discussed with the consumer. On the other hand, 100% of auto parts industry eCommerce is impacted by digital influence.

CLICK TO ENLARGE: There has been a fundamental shift in the auto parts eCommerce industry. Of the $1.9 billion in incremental revenue to the eCommerce channel in 2020, $1.2 billion is on mobile.

Auto parts eCommerce market share transacted on mobile phones accounted for $10.4 billion in the US in 2020. That’s about a 40% increase over 2019, when mobile reached $7.4 billion.

It’s common for auto parts and accessory websites to have more than 65% of total traffic on mobile devices. That’s one of the trends in online shopping that will continue.

Of the incremental shift in $1.9 billion to eCommerce reported at the top of this page, $1.2 billion of that was on mobile devices.Trends, online shopping: mobile #autoparts eCommerce sales were at $10.4 billion in the US in 2020. #DrivePartsSales Click To Tweet

Don’t delay having a defined mobile strategy for 2020 for your online retail business. That includes bid strategies and ad campaigns specifically for mobile phones.

One thing driving mobile eCommerce revenue is cross-device conversions. It’s common for a shopper to visit a website multiple times over several days or weeks, using multiple devices: maybe it’s a computer during the day at work and a phone at home in the evening. When a buying decision is reached, a shopper’s mobile phone is often the last device used to check out and buy a product.

Amazon auto parts sales

CLICK TO ENLARGE: Amazon eCommerce platform will sell $10.3 billion in auto parts, car care products, automotive accessories and OEM replacement parts in 2020.

Amazon continues to grow as a source for auto parts and accessories although they put their focus on health products for much of 2020.

Our forecast put Amazon auto parts sales, accessories, and car care products in 2020 at $8.3 billion, plus $1.9 billion in OEM replacement auto parts sales for a combined total of $10.3 billion. Amazon would likely be higher than that if they didn’t put their emphasis on health care supplies during the pandemic.

Our forecast put Amazon auto parts sales, accessories, and car care products in 2020 at $8.3 billion, plus $1.9 billion in OEM replacement auto parts sales for a combined total of $10.3 billion. Amazon would likely be higher than that if they didn’t put their emphasis on health care supplies during the pandemic.

In past years most of Amazon auto parts sales growth came from direct Fulfillment by Amazon (FBA) sales, known as first party sales or “1P.” 1P sales typically include Amazon Prime offers. Most of Amazon’s 1P sales come either from manufacturers supplying Amazon direct or from warehouse distributors (WDs). Trends, online shopping: In 2020, @Amazon sold about $10.3 billion in OEM replacement #autoparts and #aftermarket parts and accessories. #DrivePartsSales Click To TweetWe projected Amazon’s auto parts sales for 1P at $4.6 billion in 2020.

Third party sales through Amazon are known as “3P.” We projected these Amazon auto parts sales for 3P at around $5.7 billion in 2020.

We don’t include 3P sales in our annual auto parts industry analysis, only 1P. Many 3P auto parts retailers also sell through other channels. See our methodology below for more explanation.

Sales through eBay Motors: how big is eBay?

How big is eBay? We don’t attempt to track exact numbers on eBay parts & accessories revenue but aftermarket industry sources put it between $6 billion and $7 billion in 2020. We don’t include 3P revenue or auction revenue for eBay Motors in this annual online retail business analysis. This $6 to $7 billion is not included in the total projections above. See our methodology below for more explanation.

Size of auto parts marketplaces, 3P platforms

How big are third party auto parts marketplaces? What are the best auto parts eCommerce platforms other than websites? We don’t include revenue of aftermarket auto parts through auto parts marketplaces like Amazon 3P, eBay Motors or Walmart, but the folks at GCommerce do. They work with auto parts industry companies to transfer data all along the supply chain. They projected aftermarket sales to be $17 billion in 2020.

We have not tracked the Walmart auto parts marketplace, but we will be watching that closely in 2020. The Walmart auto parts marketplace is growing rapidly according to industry sources.

We’ve tracked the auto parts eCommerce market each year since 2007. We use a combination of proprietary industry research and industry interviews. We perform an analysis of trends using data from the US Census Bureau from the US Bureau of Economic Analysis. We interview industry leaders and influencers, and we do analysis of third-party data using statistical modeling and forecasting.

Revenue statistics in this article are for the US only unless specifically noted for Canada, Mexico or the North American aftermarket industry.

We only count online sales of new and re-manufactured auto parts. This includes “specialty equipment” parts and accessories and other new auto parts. It also includes replacement parts (including OEM replacement), an important category of the overall auto care industry. We don’t include used or recycled auto parts. We also don’t include data from online auctions such as eBay Motors or other third party marketplaces. These virtual marketplaces are an online sales channel where sellers sell through Amazon (separate from direct sales through Amazon), Jet.com, Newegg.com, Walmart.com, and other similar sites.

For our annual automotive industry analysis we consider eBay and most third party marketplaces to be sales channels. Many online retailers sell through their own websites as well as multiple other sales channels. Including them results in double counting. Including auctions would also include individuals selling used parts, not businesses. Automotive businesses considered for this analysis include Advance Auto Parts, Amazon, AmericanMuscle.com, AmericanTrucks.com, Auto Zone, AutoAnything.com, BuyAutoParts.com, CARiD.com, eBay Motors, ExtremeTerrain.com, JEGS.com, NAPA Auto Parts, O’Reilly Auto Parts, PartsGeek.com, RealTruck.com, RockAuto.com, SummitRacing.com, TireRack.com, U.S. Auto Parts Network Inc. (including CarParts.com and JC Whitney), as well as numerous other automotive businesses including manufacturers selling direct.

This article is copyrighted, but it’s polite to share! This content is licensed under a Creative Commons Attribution-ShareAlike 3.0 Unported License and can be distributed or quoted, with attribution given to Hedges & Company with a link to this article.

Full disclosure: Hedges & Company principals do not directly own stock in any of the companies mentioned in this article. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in investment activity. There are other liability restrictions on utilizing this market research available on our legal page.