Digital Influence on Auto Parts, Accessories and Replacement Tires

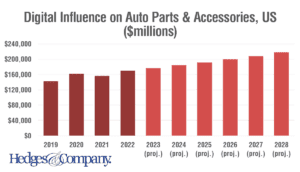

CLICK TO ENLARGE: Digital influence is everywhere and is projected at $177 billion in parts and accessories in 2023.

Digital influence on the automotive parts & accessories market will be at $177 billion in 2023 in the US. It’s projected at $200 billion in 2026 and $217.8 billion by 2028.

Note: scroll down to download a PDF of this article, no registration necessary.

Digital influence is the impact of digital media on retail sales, both online and offline. We’re all exposed to online ads, videos, social platforms, product reviews, and product information on marketplaces.1

It even includes the quality and user experience (UX) of a brand’s own website, whether that brand sells direct or not.

Digital influence is everywhere

We all spend an average of six hours, and 37 minutes online.2 Every. Single. Day. We check email, scroll through our social accounts and read up on subjects we enjoy. All that time online exposes us to a lot of non-stop brand information.

Digital Influence Definition: Creating change in opinions or behaviors based on exposure to online reviews, search engine results, social platforms postings, online videos, online brand messaging and other digital sources.

Shoppers buying big-ticket items spend a lot of time online researching products and brands before purchase, even if they buy in a brick-and-mortar retail store. Between 80% to 85% to 90% of consumers research products online before they buy.3,4,5

The percentage grows steadily over time, too. The most recent surveys show 90% of consumers do pre-purchase research. Older surveys show 80%. Our own research from 2017 puts it at 85%.

The influence of the internet on the auto aftermarket

CLICK TO ENLARGE: Digital influence on auto parts and accessory sales was at $142 billion pre-pandemic and jumped 13% in 2020 with the explosion in eCommerce.

Here’s a graph showing the growth of digital influence from the pandemic through 2028.6 This covers the United States aftermarket/auto care industry, using US dollars.

Sales of influenced parts and accessories jumped 13% in 2020. That’s when consumers largely stayed and worked at home, and shopped online.

In 2020 eCommerce sales had a similar jump. Digital influence sales went up with eCommerce sales because 100% of online sales are impacted by the internet.

Influenced sales dropped back a bit in 2021 when more consumers returned to shopping in person. The internet has a slightly lower influence on brick-and-mortar sales. Then, influenced parts and accessories sales came back in 2022 and reached a new record at $169.6 billion. That’s because the aftermarket started out very strong in 2022, both for online sales and brick-and-mortar sales.

How we calculate influence

Buyer intent helps calculate digital influence. This includes do-it-yourself (DIY) and do-it-for-me (DIFM) sales.

DIY sales channels have an extremely high digital influence

We put DIY influence at 90% in the automotive aftermarket. In other words, 90% of products sold to DIY and enthusiast consumers come under the influence of the internet in some way. It also varies by sales channel. Buying parts through an online store or marketplace is at 100% because they’re online. Other DIY sales channels such as brick-and-mortar auto parts retailers are lower.

DIFM sales channels have lower levels of influence

Many service repair businesses don’t even discuss the brands of parts used to make a service repair or used for maintenance. That makes influence lower through many DIFM sales channels. That also explains the dip in influenced sales in 2021, as more consumers visited service repair businesses. Influence on retail sales for DIFM consumers ranges from near zero to very high.

Sales channel examples

Sales channels include parts and accessories stores; online retailers; viable marketplaces like Amazon or Walmart; hardware stores; tire dealers; and independent or chain service repair stores. All of these channels have a different ratio of DIY to DIFM sales and different amounts of digital influence.

Digital influence on DIY sales

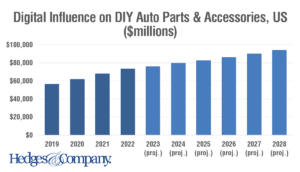

CLICK TO ENLARGE: DIY parts and accessories sales have increased steadily following the strength of the DIY channel.

DIY parts and accessories sales have a much greater impact from digital, but lower total sales volume.

DIY sales got a boost during the pandemic as more people practiced social distancing in their garages or driveways. In 2020, many consumers returned to DIY activities or took up DIY for the first time. DIY remains strong today.

DIY sales influenced by digital jumped 10% in 2020 and 2021. It dropped to an 8% increase in 2022 and we project it growing between 3% and 5% each year through 2028.

Digital influence on DIY sales impacted $56.4 billion in parts and accessories in 2019. It will reach $75.8 billion in 2023, growing to $94 billion by 2028.

The influence of the internet on replacement tire sales

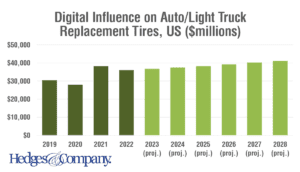

CLICK TO ENLARGE: We have digital influence affecting $30 billion in replacement tire sales in 2019, growing to $41 billion by 2028.

We separately looked at digital influence and replacement tire sales for passenger cars and light trucks. This isn’t included in the graphs above.

Influenced replacement tire sales dropped 9% in 2020. This was from a big drop in vehicle miles traveled (VMT)7 thanks to people staying at and working from home.

That rebounded in 2021 with a 37% increase.

Replacement tire sales are soft in 2022 per the U.S. Tire Manufacturers Association (USTMA). For 2022, they predict a 3.4% drop in passenger car replacement tires and a 2.4% drop in light truck replacement tires.8 Fewer tires sold means lower sales volume due to the influence of the internet.

Buying replacement tires is mostly a DIFM sales channel. Due to the high awareness of tire brands, there is a high level of influence on replacement tire sales through this channel.

Takeaways for brands and retailers

The influence of the internet is either passive (ads displayed to shoppers, seeing social postings, receiving a marketing email) or active (consumers intentionally looking for reviews or a website, receiving an abandoned shopping cart email). Passive involves high purchase-intent consumers (actively shopping and seeing ads) as well as low purchase-intent consumers (not actively shopping but still seeing ads or social postings). Active activities include looking for a brand’s website, looking at reviews, or doing product research on marketplaces or websites.

Activity on the internet is a daily habit for most consumers. Auto parts and accessories consumers are bombarded with information just about every minute spent online.

The lesson is this. To succeed in growing sales, either online or through brick-and-mortar stores, a brand or a retailer depends on the internet.

Download a PDF of this report

![]() Click here to download a PDF copy of this report.

Click here to download a PDF copy of this report.

Quoting this analysis

This article is copyrighted, but hey, it’s polite to share! This content is licensed under a Creative Commons Attribution-ShareAlike 3.0 Unported License. You may distribute or quote this article, with attribution to Hedges & Company and a link back to this article.

Note to the content folks at Statista. No, you may not copy this data and post it on your site behind a paywall.