Tag Archive for: Auto Parts Industry Trends

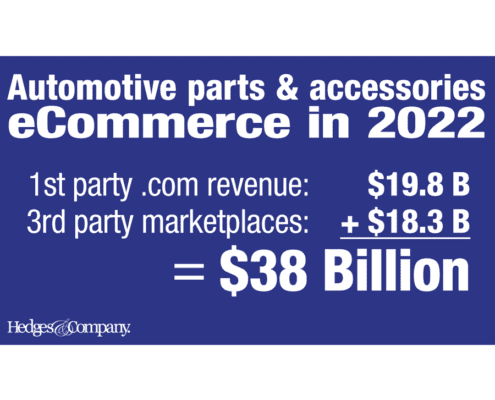

Auto Parts Industry Growth: eCommerce at $67 Billion by 2030

Auto Aftermarket News & Trends, Automotive Market ResearchAuto parts industry growth: 9% eCommerce growth rate through 2025 Compounded annual growth rate (CAGR) for parts eCommerce is projected just under 9% through 2025. Online revenue for automotive parts eCommerce revenue will reach $41 billion…

How to Perform Effective Automotive Search Engine Optimization

Automotive MarketingAs search engine optimization gets more technical each year, more people in the automotive industry ask, “what is automotive SEO?” SEO E-E-A-T covers so many areas and is different if you’re considering an automotive parts website vs. an automotive dealership website. We thought we’d break it down covering best practices and...

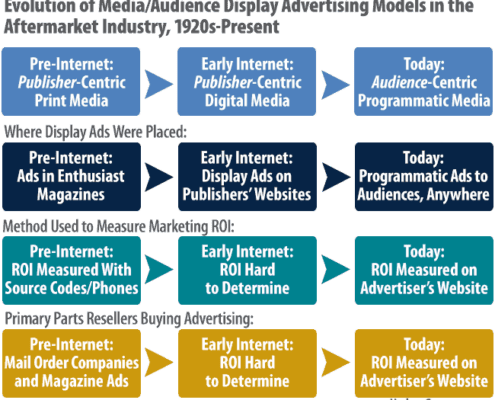

Focus on Audience Buying and Planning for Better Digital ROI

Automotive MarketingAudience buying is the new marketing strategy in 2021. Media buying has decided to take an early retirement. Media planning is stepping aside for audience planning. The world of media is going through the biggest transformation in marketing history. Marketers can now hyper-target custom audiences interested in their products and services. This marketing technology is now available for the aftermarket industry and ...

What is Programmatic Marketing?

Automotive MarketingHow programmatic marketing works in automotive: What is programmatic marketing? In the last decade, programmatic marketing shook up the marketing world in many industries. It's now available to the automotive aftermarket.It's a fundamental…

Automotive Industry Future Outlook: 2021-2024

Auto Aftermarket News & TrendsThe COVID-19 pandemic has changed the future of the automotive industry. We show the current situation and the future of the automotive industry, in just seven charts.We'll start by showing you the current impact of the pandemic on the auto…

Auto Parts eCommerce Market Share At $16 Billion in 2020

Auto Aftermarket News & Trends, Automotive Market Research, Automotive Marketing Auto parts eCommerce market share: transformational shift in 2020-2021 Note: Here's a link to a more recent article on auto parts industry growth and eCommerce projections.Trends in online shopping: automotive parts eCommerce revenue…

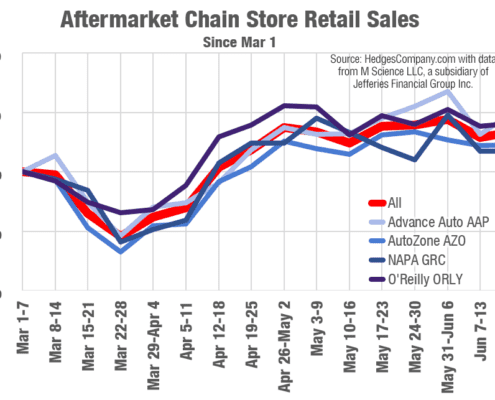

Auto Parts Chains Staging a Retail Comeback

Auto Aftermarket News & Trends, Automotive Market ResearchThe top auto parts chain stores appear to be staging a retail comeback during the coronavirus pandemic. The data includes weekly credit card transactions from AutoZone (NYSE: AZO), Advance Auto Parts (NYSE: AAP), O'Reilly Automotive (NASDAQ: ORLY) and NAPA Auto Parts (NYSE: GPC). These auto parts chains act as a bellwether for DIY activity as well as retail, two important [read more] ...

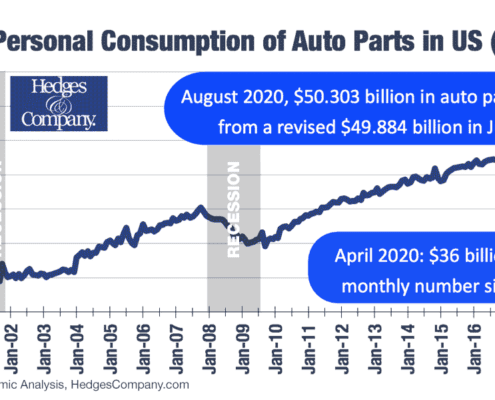

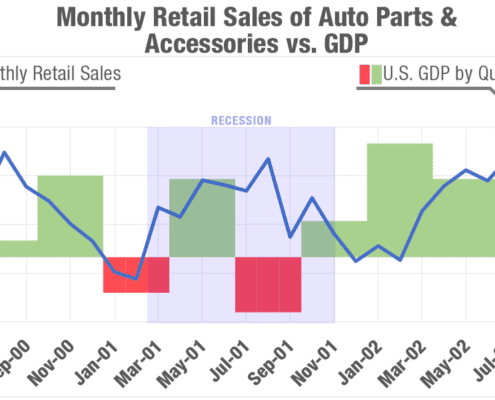

Coronavirus impact on the amazing automotive aftermarket: Recessions, stock market crashes, unemployment

Auto Aftermarket News & Trends What's the coronavirus impact on the auto aftermarket? What is the COVID-19 and coronavirus impact on the auto aftermarket? Most economists seem to agree right now that we're probably heading into a recession. (This is written March 27, 2020.)…

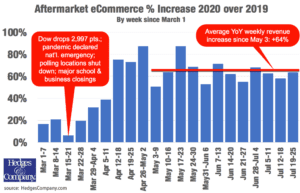

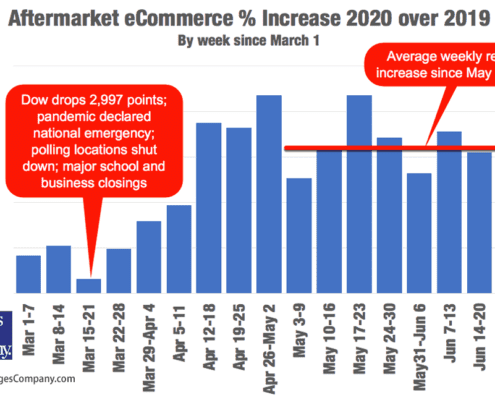

Updated 7/28/20: Coronavirus and Automotive Aftermarket eCommerce News

Auto Aftermarket News & Trends, Automotive Market Research, Automotive MarketingNote: See related article, click here: Auto parts chain store sales trends. Aftermarket eCommerce maintaining big increase from 2019(July 28) Data shows the aftermarket eCommerce channel has a significant year-over-year (YoY) revenue…

Future of the Automotive Industry: 2020 Predictions by Automotive Industry Experts

Auto Aftermarket News & TrendsIndustry experts give their predictions of automotive aftermarket industry trends for 2020. They offer their takes on video advertising, website design and speed, product data and AI. There are also predictions on 3P marketplaces including Walmart, Amazon and...

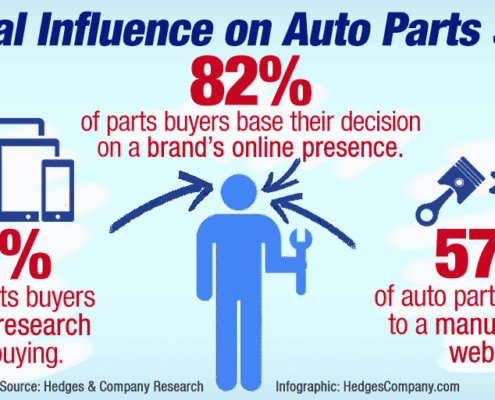

Auto Parts Retail Industry: Internet’s Influence on Retail Auto Parts Sales

Auto Aftermarket News & Trends, Automotive Market Research, Automotive MarketingIn our auto parts retail industry analysis, we show how digital influence is driving billions of dollars in retail sales and it's not stopping. Nearly all offline retail sales begin online.Our latest auto parts retail industry outlook shows…