Characteristics of Automotive DIY Consumers

DIY auto maintenance market

DIY auto maintenance market

A recent survey published by the Auto Care Association using analysis from Hanover Research analyzes the characteristics and buying behaviors of automotive maintenance DIYers.

The focus of the research study was to investigate the primary reasons for DIY consumer and do-it-for-me consumer (DIFM) behavior. Mike Chung, Auto Care Association’s Senior Director of Market Intelligence, generously gave Hedges & Company the opportunity to analyze the raw data. We used that to focus on DIY auto maintenance consumers.

![]() Hedges & Company examined what type of automotive maintenance do-it-yourself consumers perform. We also looked at how they gather information to give them the skills and confidence to do it themselves, and what sources of information DIYers consider to be reliable.

Hedges & Company examined what type of automotive maintenance do-it-yourself consumers perform. We also looked at how they gather information to give them the skills and confidence to do it themselves, and what sources of information DIYers consider to be reliable.

Size of the DIY auto maintenance market

Before we get into the details of automotive DIY consumer demographicsand behavior, let’s start with the size of the DIY automotive maintenance market in the US.

DIY maintenance market growth

According to the Auto Care Association annual 2026 Factbook, the DIY auto parts market grew about 65% from 2017 to 2025. That works out to a 5.3% compounded annual growth rate (CAGR). The DIFM auto parts market grew about 53% in that same time frame, for a 9.8% CAGR. Although the DIY share of the auto parts market is smaller than DIFM (DIY has historically been 19%-20% of the total parts market), the 5.3% CAGR shows that DIY growth has been strong.

This growth was also partially fueled by the pandemic. There was a big spike in DIY behavior in 2020 and 2021. Post-pandemic DIY market share returned to normal but a lot of consumers that turned to DIY during the pandemic continued with DIY.

DIY auto maintenance market size

The DIY auto maintenance market was around $84 billion in 2025 according to the Auto Care Association. Hedges & Company projects the automotive DIY market to be at approximately $109 billion by 2030. The DIY market represents around 20% of the total automotive aftermarket in the US.

The automotive DIYers

DIYers work on their own vehicles, either to save money or as their hobby. There’s a wide spectrum of projects when it comes to types of vehicle maintenance, or vehicle enhancement projects these DIYers will tackle. It may be as simple as changing wipers, or as complex as working on an engine. Hard core DIY automotive enthusiasts will take on more complex projects such as engine rebuilds and extensive vehicle customization.

DIYers work on their own vehicles, either to save money or as their hobby. There’s a wide spectrum of projects when it comes to types of vehicle maintenance, or vehicle enhancement projects these DIYers will tackle. It may be as simple as changing wipers, or as complex as working on an engine. Hard core DIY automotive enthusiasts will take on more complex projects such as engine rebuilds and extensive vehicle customization.

Note: This article reports on 2 things. One is the percentage of DIYers’ answers. The other is the increased likelihood for DIYers to do something, compared to a DIFM consumer.

Reasons to do DIY maintenance

Reasons to do DIY maintenance

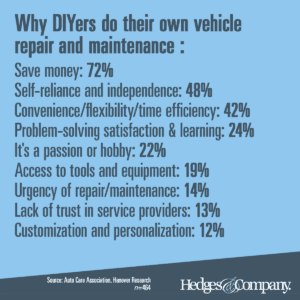

According to the Hanover data, the top three reasons DIYers do their own vehicle maintenance and repair are: Saving money; having self-reliance and independence; and the convenience and flexibility of DIY activity.

The research had interesting findings on automotive DIY consumer demographics. DIYers are more likely than DIFM consumers to have an annual household income in two ranges: $60,000 to $79,999 and $100,000 and $149,999.

DIYers tend to either be self-employed, stay-at-home parents, or employed full-time. Automotive DIY consumers are 51% more likely to “strongly agree” with the statement, “I frequently look at shows/programs related to vehicle maintenance and care.”

Hedges & Company also analyzed the number of automotive DIY consumers in the US in a separate article. There are nearly 26 million DIYers and automotive enthusiasts in the US.

Automotive DIY consumers skew younger than DIFM consumers. Exactly half of all DIYers are 18-44 years old, compared to 38% of DIFM consumers. 62% of DIFM consumers are 45 and older, vs. 50% for DIYers.

What maintenance projects DIYers work on

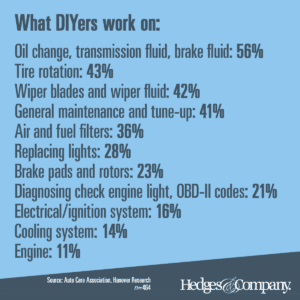

Most commonly performed DIY projects include changing oil, transmission fluid or brake fluid; rotating tires; changing wiper blades and fluid; and general maintenance and tune-up.

The Hanover data also compares DIY to DIFM consumer activity, not just what activity is performed. It shows DIYers are 71% more likely than DIFMs to do maintenance on the lighting system or exhaust system of a vehicle. They are also 52% more likely to do maintenance on the cooling system or steering system; 46% more likely on the electrical/charging system; and 42% on the suspension system.

DIY auto repair by vehicle makes

The top two makes for DIYers are American-based Ford and Chevy. This is followed by Asian makes Toyota, Honda and Nissan. On the other hand, the top make for DIFM consumers is Toyota, followed by Chevy.

Makes more likely to get DIY work

DIYers are 74% more likely to work on Volkswagen vehicles; 57% more likely to work on Chrysler brand vehicles; 20% more likely to work on Chevy vehicles; and 19% more likely to work on Fords and BMWs (tie).

DIYers are less likely to work on Asian brands. DIFM consumers are 36% more likely to have work performed on Mazdas; 28% more likely on Hyundais; 21% on Subarus; and 9% on Nissans. The American brand Buick is also more likely to get DIFM work done, at 25%.

Best sources of information for DIYers

Best sources of information for DIYers

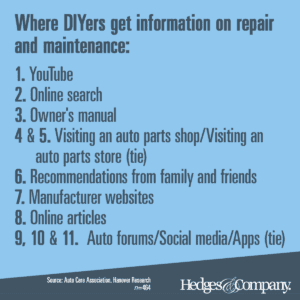

The research looked at where DIY consumers go to get information on how to complete their projects. Understandably, YouTube was a top source, with DIYers 81% more likely to look at YouTube, which is sometimes called the “world’s second-largest search engine.”

Other sources identified as more likely are: reading online articles, 66% higher; consulting mobile apps dedicated to vehicle maintenance, 58%; reading DIY auto maintenance forums and online communities 55%; and consulting consumer review websites, 51%.

Manufacturers should note that DIYers are 17% more likely than DIFMs to specifically seek out manufacturer websites for information.

Reliability of information sources

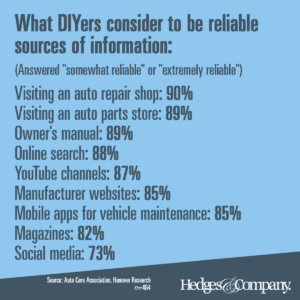

DIYers had widely varying opinions on the reliability of information sources.

The most reliable information came from visiting an auto repair shop, which 90% of DIYers said was either “somewhat reliable” or “extremely reliable.” Visiting an auto parts store and consulting the owner’s manual came in next at 89%.

The most reliable information came from visiting an auto repair shop, which 90% of DIYers said was either “somewhat reliable” or “extremely reliable.” Visiting an auto parts store and consulting the owner’s manual came in next at 89%.

Online search and YouTube are next at 88% and 87%, respectively. Manufacturer websites and mobile apps are both at 85%.

Magazines are at 82%, and social media was significantly below that, with 73% of DIYers considering social media as a reliable source of information.

Other vehicles owned

DIYers are 66% more likely than DIFMs to own five or more vehicles. They’re also 24% more likely to own a popular pickup truck.

In addition to a car or truck, automotive DIY consumers are 73% more likely to have a scooter; 50% more likely to have a motorcycle; 42% more likely to have an RV; 48% more likely to have an ATV; and 30% more likely to have a boat.

The average model year for the primary vehicle owned by automotive DIYers was 2013, vs. 2016 for DIFM consumers. (Maybe DIYers are contributing to the rising average age of cars!)

Frequency of DIY activity

Automotive DIY consumers perform frequent vehicle maintenance on their primary vehicle. They are 32% more likely to do service maintenance every 3,000 miles or 3 months. They’re also 37% more likely to do maintenance based on specific driving conditions. On the other hand, DIFM consumers are 37% more likely than DIYers to admit to doing service maintenance less frequently than every 10,000 miles or every 12 months. (Tip: If buying a used car from an individual, find out if they’re a DIYer!)

Automotive DIYers are 51% more likely to do maintenance based on seasonal changes. They’re also 50% more likely to do maintenance in advance of a trip, 48% more likely to do maintenance in response to a change in vehicle performance, and 32% more likely in response to fluid leaks.

We also get asked occasionally how many car enthusiasts there are in the US and the answer is about 26 million in 2025.

Methodology

The DIY auto maintenance market research was conducted by Hanover Research at the direction of the Auto Care Association. The research was completed in January 2024. Hanover surveyed U.S. adults who own a personal vehicle, are involved in maintenance decisions, recently performed maintenance or service on their vehicle, and don’t work in the automotive repair industry. The survey was administered online, and respondents were recruited through an online panel. The analysis includes a total of 1,081 respondents after data cleaning and quality control.

Frequently asked questions

Q: How big is the DIY auto maintenance market in the US?

A: The DIY auto maintenance market was $84 billion in 2025. Hedges & Company projects it to be approximately $109 billion by 2030.

Q: What motivates automotive DIY consumers to perform their own vehicle maintenance?

A: According to a 2024 survey by the Auto Care Association, the top reasons include saving money, self-reliance, and the convenience of DIY activities.

Q: How has the DIY auto maintenance market grown in recent years?

A: The DIY auto parts market experienced significant growth between 2017 and 2024, with a 59% increase, equating to a 5.96% compounded annual growth rate (CAGR). This growth indicates a rising trend of consumers opting to perform their own vehicle maintenance and repairs.

Q: What are the demographic characteristics of automotive DIY consumers?

A: DIYers tend to have annual household incomes ranging from $60,000 to $79,999 and $100,000 to $149,999. They’re typically self-employed, stay-at-home parents, or employed full-time. Additionally, DIY consumers tend to be younger, with 50% between 18 and 44 years old.

Q: Where to DIYers get information on how to complete their projects?

A: DIYers are 81% more likely than non-DIYers to look at YouTube, and 66% more likely to read online articles.

This article is copyrighted, but it’s polite to share! This content is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License and can be distributed or quoted, with attribution given to Hedges & Company, and a link back to this article from your website.