Tag Archive for: Recession

Automotive Industry Future Outlook: 2021-2024

Auto Aftermarket News & TrendsThe COVID-19 pandemic has changed the future of the automotive industry. We show the current situation and the future of the automotive industry, in just seven charts.We'll start by showing you the current impact of the pandemic on the auto…

Coronavirus impact on the amazing automotive aftermarket: Recessions, stock market crashes, unemployment

Auto Aftermarket News & Trends What's the coronavirus impact on the auto aftermarket? What is the COVID-19 and coronavirus impact on the auto aftermarket? Most economists seem to agree right now that we're probably heading into a recession. (This is written March 27, 2020.)…

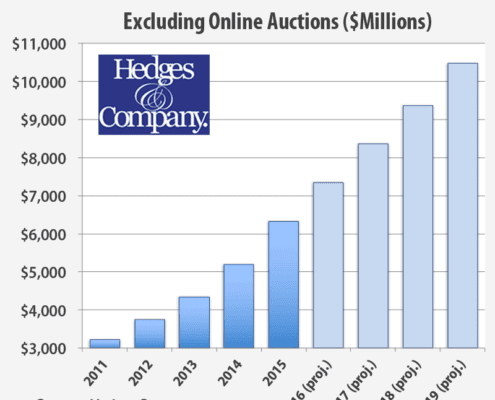

Auto Parts Marketing: Online Parts Sales to Reach $7.4 Billion in 2016

Auto Aftermarket News & Trends, Automotive MarketingNote: this article is from January 2016. For more current information, click here for automotive aftermarket trends. How big is the automotive aftermarket industry?ECommerce auto parts sales narrowed the gap with traditional brick…

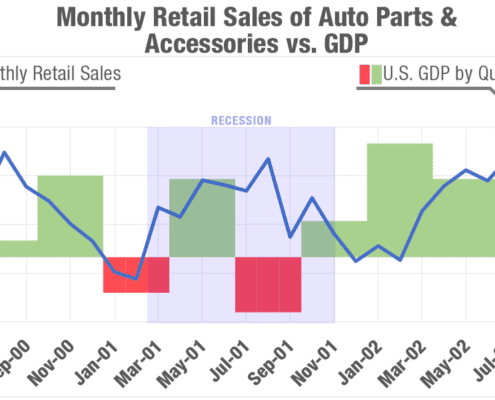

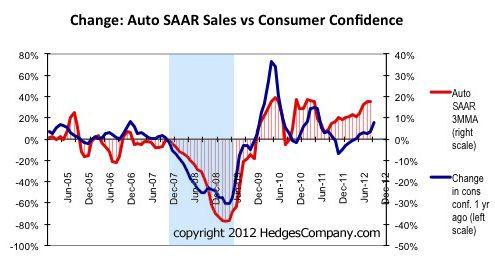

Why New Car Auto Sales Are Rising

Auto Aftermarket News & Trends, Automotive Market Research, Automotive MarketingWith monthly auto sales rising here are reasons for the continuing increase in automobile and light truck sales in the face of a weak economy.The auto industry tracks monthly unit sales as a seasonally adjusted annual rate (SAAR) figure,…

A Sign Auto Parts Retail Sales Are Slowing?

Auto Aftermarket News & Trends, Automotive MarketingToday's trend is a little concerning: the growth in auto parts sales is slowing down compared to the first half of 2012. This is important to watch as you plan your company's automotive aftermarket forecast for 2013. Auto parts trends 2012 Retail…

Trend 19: Auto Sales Rise in August and September

Auto Aftermarket News & Trends, Automotive Market ResearchThe US automotive industry has always played a large part in the economy, and the same industry that once needed a taxpayer bailout to stay alive may be the one to stave off another recession. Over the past two years, Ford Motor Co., General…

Retail Auto Parts Sales Outlook for 2012

Auto Aftermarket News & Trends, Automotive Market Research, Automotive MarketingWelcome back to our blog! Today we'll look at auto aftermarket Trend 25: Our outlook for retail auto parts and accessories sales for 2012 and two important industry trends you should know: Auto parts trends 2012 1). January-June 2012 showed…

Trend 49: The Economy And Auto Parts Sales: Personal Income

Auto Aftermarket News & Trends, Automotive Market ResearchRetail sales of auto parts and accessories are influenced by many things in the economy. One component of our sales forecasting model at Hedges & Company is personal income, so for today's trend we look at how that affects retail sales…

How will 2011 be for the Automotive Aftermarket Industry?

Auto Aftermarket News & TrendsHappy New Year for the automotive aftermarket industry! Following up on our popular blog post "What If You Invested $1,000 in Automotive Aftermarket Companies" the Hedges & Company Automotive Aftermarket Index finished 2010 with a 48% gain.…

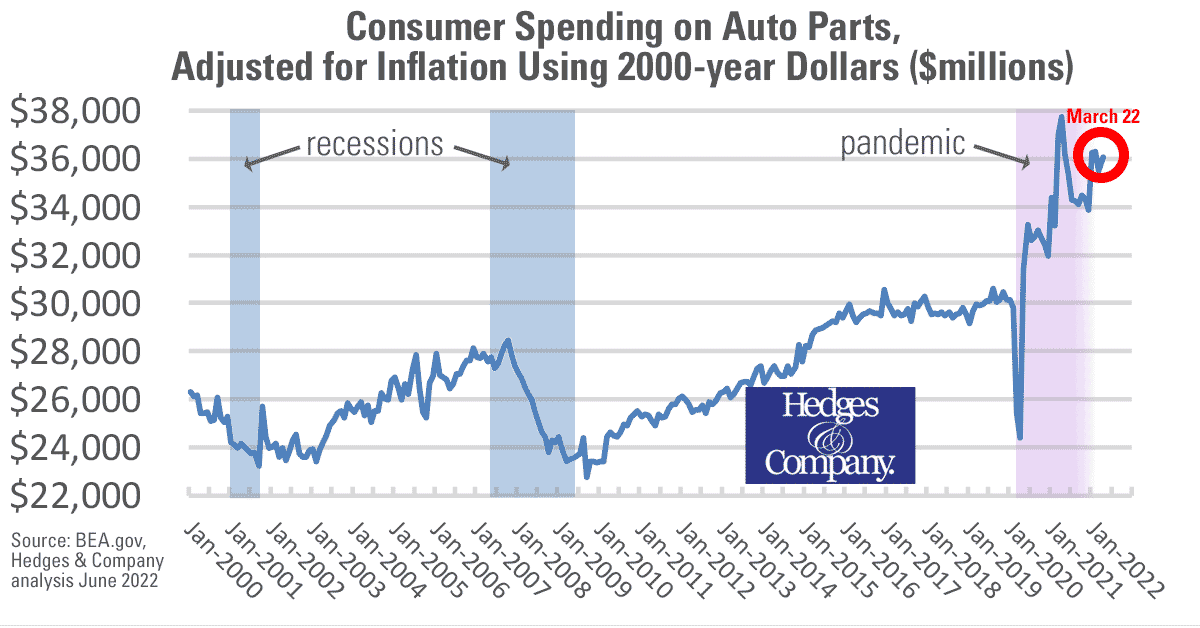

Why Was The Great Recession Different? It Was the Double-Dip In Auto Parts Sales

Auto Aftermarket News & TrendsWhen looking at the auto parts retail segment of the economy, the Great Recession not only lasted longer than previous recessions, but our market research shows auto parts retail sales also had a double-dip. For all the talk in the news media…