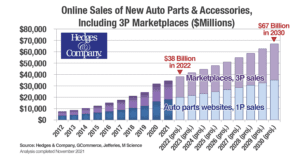

Auto Parts Industry Growth: eCommerce at $67 Billion by 2030

Auto parts industry growth: 9% eCommerce growth rate through 2025

Compounded annual growth rate (CAGR) for parts eCommerce is projected just under 9% through 2025. Online revenue for automotive parts eCommerce revenue will reach $41 billion in 2023 in the US.

2022 online revenue included $19.8 billion from automotive eCommerce websites and first-party (“1P”) sellers selling direct, including Amazon FBA (“fulfilled by Amazon”). It also included $18.3 billion revenue from third party marketplaces (“3P”), like sellers using Amazon marketplaces as a platform to sell their products. This includes the “SEMA” specialty equipment market as well as the OEM replacement parts market.

1P and 3P auto parts industry growth in the US is projected to end up at $67 billion by the year 2030.

1P and 3P auto parts industry growth in the US is projected to end up at $67 billion by the year 2030.

Hedges & Company produced this data for the AASA/Auto Care Association Joint eCommerce Forecast, the most comprehensive auto parts industry growth report of its kind. We worked with GCommerce, Jefferies and M Science to validate and forecast this eCommerce revenue data.

CLICK TO ENLARGE: This graph shows auto parts industry growth, combining 1P and 3P online revenue. Total revenue is forecasted at $67 billion 2030. 3P revenue is shown in purple, 1P revenue is shown in blue.

Total aftermarket eCommerce (1P + 3P) revenue grew by 30.6% in 2020 from the previous year. That growth spurt is directly related to the COVID-19 pandemic. Most industries, not just automotive, had record eCommerce revenue growth.

Most eCommerce retailers started 2021 with 30%, 50% and even 100%+ growth. However, that growth rate has tended to slow down through the year so we have 2021 at an overall 11.7% revenue increase.

2022 is projected at a lower growth rate than 2021. We’re projecting overall growth of 9.7%. That settles down a bit to just under 9% CAGR industry growth 2020-2025.

Many eCommerce parts & accessories retailers had supply chain difficulties through 2022. That played a significant role in the overall growth rate that year.

A major problem in our industry was inventory availability, not consumer demand.

Here’s how these eCommerce revenue numbers break down:

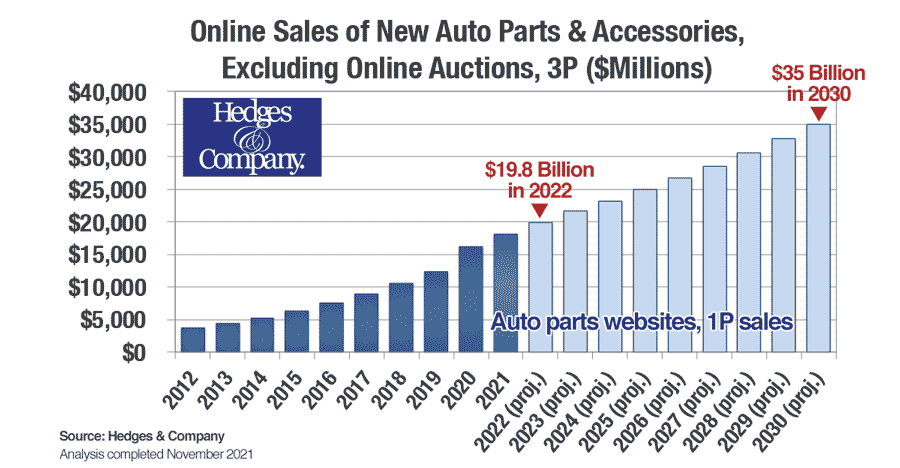

Auto parts industry growth: 1P revenue

CLICK TO ENLARGE: This graph shows online revenue of new auto parts and accessories, excluding online auctions and 3P marketplaces, projected through 2030.

“1P” or first party eCommerce revenue includes, obviously, eCommerce websites. This can be retailers or it can be manufacturers selling direct to consumers (DTC). Some of 1P sales come from Amazon, selling direct as a retailer via Fulfilled by Amazon (although the majority of revenue through Amazon comes from third party, or “3P” sales). Some of this 1P revenue is from eCommerce companies who have a website but also sell on eBay.

This graph shows 2022 revenue projected at $19.8 billion, and by 2030 it is projected at a whopping $35 billion.

We’re estimating automotive parts & accessories eCommerce in Canada at CA$6.4 billion/US$5.2 billion in 2022, and Mexico at just over US$1.1 billion in 2022. That projects to US$26.1 billion for North America in 2022.

Auto parts industry growth: 3P revenue

“3P” or third party eCommerce revenue includes products sold by companies (or indivduals) that sell through third-party marketplaces such as Amazon, eBay, Walmart or Newegg. These third-party marketplaces collect a fee in exchange for listing and selling a product on their platform. The chart at the top of this page shows 3P sales in purple. These projections show aftermarket 3P revenue at $18.3 billion in 2022 and $32.1 billion in 2030.

eBay Motors revenue is estimated at $11.7 billion in 2021.

3P revenue through most of 2020, especially on Amazon, was held back in favor of stocking, selling and shipping health-related products to deal with the pandemic. Otherwise 3P sales would have increased at a greater rate as they did for 1P in 2020.

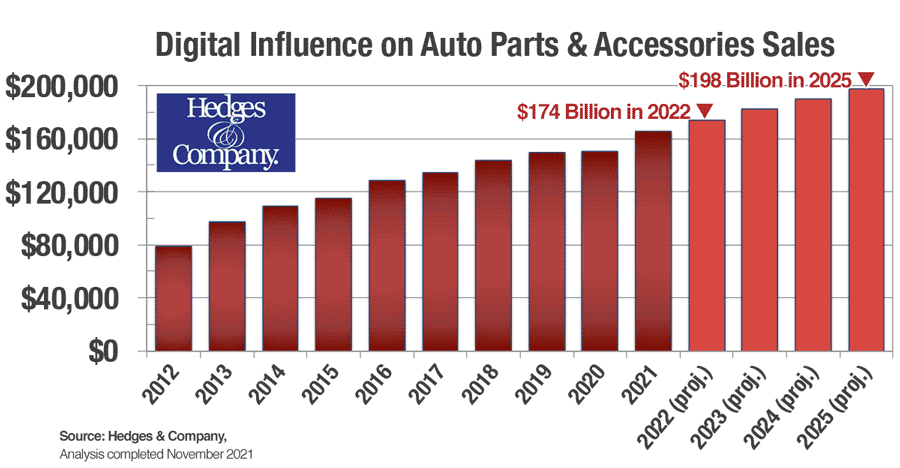

CLICK TO ENLARGE: Digital influence on all retail sales, online and offline, in the US. $174 billion in auto parts & accessories revenue will be influenced by digital in 2022, reaching nearly $200 billion by 2025.

We are grateful for the investigative work by GCommerce, Jefferies and M Science to produce these 3P estimates for 2021.

Digital influence on retail revenue

Digital influence has a huge effect on the auto parts retail industry. $174 billion in retail revenue in the automotive industry in the US will be influenced by digital in 2022. That includes both online and offline revenue. It includes revenue through sales channels like brick and mortar retail stores, including chain stores (AutoZone, Advance Auto) or independent auto parts retailers.

Here’s our definition of “digital influence.”

It’s simply the affect on a consumer who does online research before buying an auto part or accessory. More than nine out of 10 shoppers do online research even if they plan to buy in a retail store. Digital influence comes from blog posts, product images, website content, installation instructions, online advertising, consumer reviews, “how-to” content on YouTube, video ads and video content.

Auto parts industry growth summary:

Here’s a summary of important numbers.

• 1P eCommerce revenue in the US is projected at $19.8 billion in 2022.

• 1P eCommerce in Canada is forecasted at CA$6.4 billion/US$5.2 billion in 2022.

• 1P eCommerce in Mexico at US$1.1 billion/MX$22.7 billion in 2022.

• 3P eCommerce revenue in the US is projected at $18.2 billion in 2022.

• North American eCommerce 1P revenue projected at US$26.1 billion in 2022.

• $174 billion in parts revenue will be influenced by digital in 2022, rising to $198 billion in 2025.

• Amazon 1P and 3P parts & accessories revenue is about $12B in in 2021.

• eBay Motors parts & accessories revenue was about $11.7 billion in 2021

We’ve tracked the auto parts eCommerce market each year since 2007. We use a combination of proprietary industry research and industry interviews, then perform an analysis of trends using data from the US Census Bureau from the US Bureau of Economic Analysis. We interview industry leaders and influencers, and we do analysis of third-party data using statistical modeling and forecasting. If you follow our annual projections you’ll notice something different this year: we combined 1P revenue with 3P revenue for the first time. Also new this year, our partnership with GCommerce, Jefferies, M Science, the Auto Care Association and AASA.

Revenue statistics in this article are for the US only unless specifically noted for Canada, Mexico or the North American aftermarket industry.

We only count online sales of new and re-manufactured auto parts. This includes “specialty equipment” parts and accessories and other new auto parts. It also includes replacement parts (including OEM replacement), an important category of the overall auto care industry. We don’t include used or recycled auto parts.

Automotive businesses considered for this analysis include Advance Auto Parts, Amazon, AmericanMuscle.com, AmericanTrucks.com, Auto Zone, AutoAnything.com, BuyAutoParts.com, CARiD.com, eBay Motors, ExtremeTerrain.com, JEGS.com, NAPA Auto Parts, O’Reilly Auto Parts, PartsGeek.com, RealTruck.com, RockAuto.com, SummitRacing.com, TireRack.com, U.S. Auto Parts Network Inc. (including CarParts.com), as well as numerous other automotive businesses including manufacturers selling direct.

Quoting this auto parts industry growth forecast

This article is copyrighted, but hey, it’s polite to share! This content is licensed under a Creative Commons Attribution-ShareAlike 3.0 Unported License and can be distributed or quoted, with attribution given to Hedges & Company with a link to this article.

Full disclosure: Hedges & Company principals do not directly own stock in any of the companies mentioned in this article. This material has been prepared for informational purposes only, and is not intended to provide – and should not be relied on – for tax, legal or accounting advice. This special report is not a substitute for your own tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in investment activity. There are other liability restrictions on utilizing this market research available on our legal page.