Demographics of Car Buyers

We get asked a lot of questions about demographics of new car buyers. We wanted to do some in-depth data analysis to see who buys new cars.

Buying a new vehicle is a major household expenditure. It is reported that Baby Boomers purchase 62% of new cars in the US. Millennials will soon account for most new vehicle purchases. An interesting factor is how difficult it is to find and buy a new car after the pandemic in 2020 and 2021.

A new (or used) vehicle is important to a lot of Americans because 85% have a drivers’ license.

Average age of a new car buyer

Research published by the Federal Reserve shows the age of a new car or truck buyer has grown older over the past decade. It is now around 53 years old. They also note that among new vehicles buyers, the 55+ age group has a 15 percentage point increase since 2000.

Here are some demographics of new car and truck buyers. This is pulled from the automotive mailing list database of 170+ million vehicle owners. They are buyers of new 2018 and 2019 model year vehicles.

And to clarify a question on these stats that came up in a recent LinkedIn posting, the car buyer demographic stats, as well as our mailing list data, are based on the owner of the vehicle. They don’t account for who influenced a purchase.

Average income secondary to affordability concern with new car buyers

According to a study released by Cox Automotive, 64% of new car buyers rated affordability as “important.” Late 2018 is the most recent data from this particular study and the topic wasn’t included in the 2020 edition, which focused more on process and satisfaction. About half—53%—consider the total purchase price. 20% instead consider the monthly payment. The remainder, 27% consider the total purchase price along with the monthly payment. The percentages only varied by a point for new car buyers vs. used car buyers.

Links to other car buyer demographic articles you may like:

Car ownership by age

Who buys new cars and trucks? When it comes to car ownership by age, buyers that are ages 25 to 54 purchase most new vehicles.

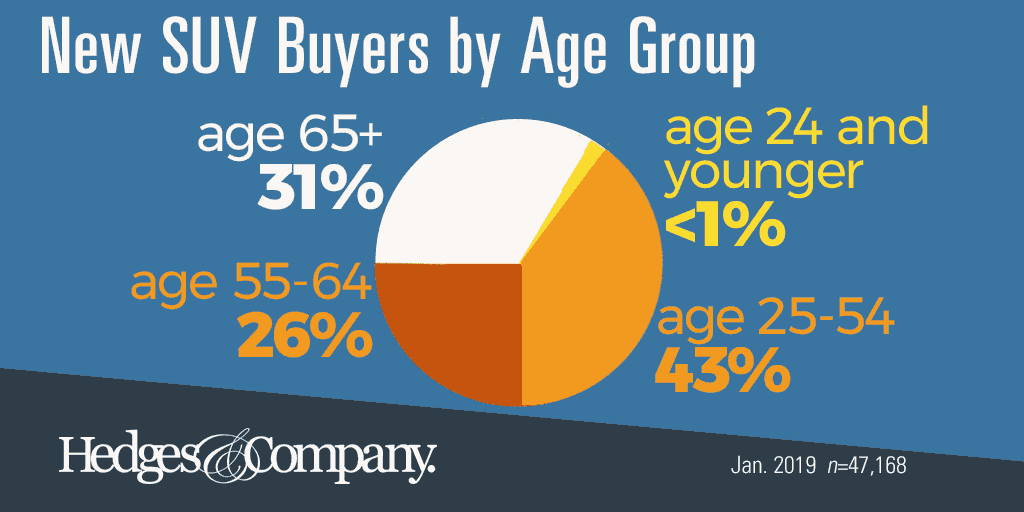

Who buys SUVs? SUV buyers tend to skew just a bit older. Here’s a look at car and truck buyer demographics by age group.

| Age 24 and younger | less than 1% |

| Age 25 to 54 | 43% |

| Age 55 to 64 | 26% |

| Age 65 and up | 31% |

| Age 24 and younger | 1% |

| Age 25 to 54 | 51% |

| Age 55 to 64 | 21% |

| Age 65 and up | 27% |

| Age 24 and younger | less than 1% |

| Age 25 to 54 | 50% |

| Age 55 to 64 | 23% |

| Age 65 and up | 26% |

| Age 24 and younger | less than 1% |

| Age 25 to 54 | 46% |

| Age 55 to 64 | 22% |

| Age 65 and up | 32% |

| Age 24 and younger | less than 1% |

| Age 25 to 54 | 54% |

| Age 55 to 64 | 22% |

| Age 65 and up | 23% |

| Age 24 and younger | 1% |

| Age 25 to 54 | 47% |

| Age 55 to 64 | 28% |

| Age 65 and up | 24% |

| Age 24 and younger | 1% |

| Age 25 to 54 | 55% |

| Age 55 to 64 | 25% |

| Age 65 and up | 19% |

| Age 24 and younger | 1% |

| Age 25 to 54 | 46% |

| Age 55 to 64 | 29% |

| Age 65 and up | 24% |

| Age 24 and younger | Less than 1% |

| Age 25 to 54 | 45% |

| Age 55 to 64 | 27% |

| Age 65 and up | 27% |

Income of car buyers

Two household income groups account for most new vehicle purchases: Under $50,000 per year (mostly single-person households) and $100,000 per year and up (mostly families). Here we look at income by vehicle type.

| Under $50,000 | 31% |

| $50,000 to $74,999 | 19% |

| $75,000 to $99,000 | 10% |

| $100,000 and up | 40% |

| Under $50,000 | 39% |

| $50,000 to $74,999 | 18% |

| $75,000 to $99,000 | 9% |

| $100,000 and up | 34% |

| Under $50,000 | 37% |

| $50,000 to $74,999 | 20% |

| $75,000 to $99,000 | 10% |

| $100,000 and up | 33% |

| Under $50,000 | 21% |

| $50,000 to $74,999 | 12% |

| $75,000 to $99,000 | 10% |

| $100,000 and up | 57% |

| Under $50,000 | 20% |

| $50,000 to $74,999 | 16% |

| $75,000 to $99,000 | 4% |

| $100,000 and up | 60% |

A new car buyer, according to the National Automobile Dealers Association (NADA) in 2015, earned about $80,000 per year.

EV owner demographics

A study by the University of California-Davis showed that in California, people with income over $150,000 per year purchase a third of electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs). People with household income of $100,000 to $149,000 account for about 20% and people with household income of $50,000 to $99,999 per year account for about 27% of these vehicles.

Vehicle ownership by gender

New vehicle ownership by gender varies a lot. For example, the majority of new truck buyers (86%) are male, while SUV buyers are more evenly distributed.

| Female | 43% |

| Male | 57% |

| Female | 44% |

| Male | 56% |

| Female | 14% |

| Male | 86% |

| Female | 25% |

| Male | 75% |

| Female | 25% |

| Male | 75% |

New car buyer demographics by home ownership

Most new vehicle buyers own their own home.

| Own home | 93% |

| Don’t own/rent | 7% |

| Own home | 93% |

| Don’t own/rent | 7% |

| Own home | 90% |

| Don’t own/rent | 10% |

In-Market New Vehicle Buyer Audiences

Here is a table showing the estimated monthly audience impressions available for people actively searching for a particular type of vehicle. These are auto intenders, commonly called an “in-market audience.” They’re active online, searching for information about new vehicles and researching various models and makes of new vehicles.

These consumers are visiting OEM websites and automobile dealer websites, looking at vehicle specs and pricing.

We can reach these digital audiences with highly targeted online advertising.

| Compact Cars | 560,000,000 |

| Convertibles | 22,000,000 |

| Coupes | 20,000,000 |

| Crossovers (CUVs) | 91,000,000 |

| Diesel Vehicles | 250,000,000 |

| Hatchbacks | 330,000,000 |

| Hybrid Vehicles | 300,000,000 |

| Luxury Vehicles | 430,000,000 |

| Subcompact Cars | 31,000,000 |

| Pickup Trucks | 610,000,000 |

| SUVs | 1,100,000,000 |

| Sedans | 450,000,000 |

| Sports Cars | 380,000,000 |

| Station Wagons | 8,800,000 |

| Minivans | 10,000,000 |

Do you need to reach new vehicle buyers, or prospective new vehicle buyers with a postal mailing list? Or do you need vehicle owner market research? We can help you with postal or email conquest lists, and we can help with market research projects. Just give our office a call or click on this button to fill out a simple form. Our new vehicle buyer demographics are pulled from a masterfile of 170 million vehicle owners in the U.S., which is updated monthly and weekly. We also have automobile recall lists available as well as other types of automotive direct mail.