Auto Parts Retail Industry: Internet’s Influence on Retail Auto Parts Sales

In our auto parts retail industry analysis, we show how digital influence is driving billions of dollars in retail sales and it’s not stopping. Nearly all offline retail sales begin online.

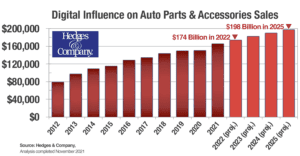

Our latest auto parts retail industry outlook shows that digital influence affects about $140 billion in parts and accessory retail sales in 2020. That will grow to $168 billion through all auto parts retail channels by 2023. This includes offline retail through chain stores like AutoZone or Advance Auto, automobile dealers, local independent brick & mortar retailers, and jobbers. Most of this is occurring on mobile phones.

Digital obviously already influences online sales, including online retailers and manufacturers selling direct to consumers (DTC), which is growing rapidly.

Unfortunately many independent brick and mortar retailers are still unprepared to bridge the digital divide.

Auto parts retail and digital

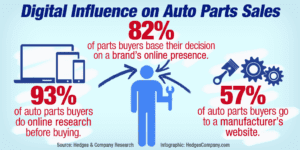

Auto parts retail industry: Digital influence on #autoparts retail sales to hit $168 billion by 2023 through all brick and mortar retail channels. #DrivePartsSales Click To TweetHedges & Company research over the past year or so has shown that 93% of auto parts buyers do online research before making a purchase, whether that purchase is made online or in a retail store. That’s an amazing statistic.

Our auto parts retail industry analysis shows the impact of digital among auto parts buyers is stronger than in many other industries.

Over half of parts buyers go to manufacturer websites during the pre-purchase research phase. More than four out of five parts buyers base their decision to buy on a brand’s online presence. Let that sink in for a moment: before making a purchase, even in a retail store, more than half of parts buyers visit a manufacturers’ website as part of the buying process.

This is also true when it comes to the consumer’s shopping process for a new or used car. According to Think With Google 92% of automobile purchasers are researching online before buying. That is amplified during Covid-19, when consumers want to learn as much about a vehicle before even leaving their homes.

Digital impact in auto parts retail industry: $168 billion by 2023

Auto parts retail revenue influenced by digital will hit $140 billion in 2020 and will grow to $168 billion by 2023.

Digital influence is defined as consumers doing online research before buying a part, finding information and verifying fitment on a manufacturer’s website, exposure to online advertising, finding product or reseller reviews, reading automotive forums, or conducting searches on Google or Bing.

If parts shoppers are doing research online, how are they doing it? Our automotive retail trends research shows the biggest category is online search (74% of all consumers), followed by auto parts retailer websites (73%), manufacturer websites (57%) and automotive forums (47%).

Amazon.com auto parts sales

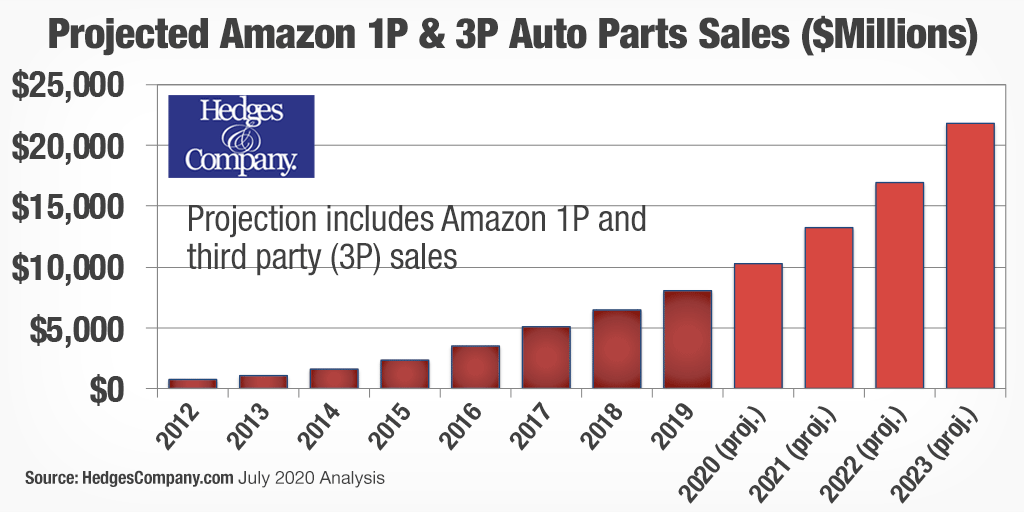

In any article about automotive retail industry trends, we have to include Amazon auto parts sales, which continue to climb.

In any article about automotive retail industry trends, we have to include Amazon auto parts sales, which continue to climb.

We project Amazon auto parts retail revenue will hit $10.3 billion in 2020.

Most of these sales are from aftermarket parts & accessory sales.

These sales levels include sales directly from Amazon, known as “first party sales” or “1P.”

If you are buying directly from Amazon the product will show Fulfillment by Amazon (FBA). This also includes third party sales through Amazon as a marketplace, sometimes referred to as “3P.”

Manufacturers supply most of Amazon’s 1P sales. Manufacturers ship directly to Amazon or warehouse distributors (WDs) ship to Amazon.

Auto parts retail industry trends to watch

What’s next with digital influence on retail in automotive industry trends?

The integration of B2C and B2B sales models is a trend to follow, as digital influence continues to grow.

The growing trend of manufacturers selling direct to consumers is another trend to follow. More manufacturers are short-circuiting traditional distribution channels for auto parts and selling direct to consumers. Hedges & Company research shows that not only do over half of consumers visit manufacturer websites, about a third of them come to the website fully prepared to make a retail purchase, direct from the manufacturer.

Mobile continues to grow in the sphere of digital influence. Retail sales on mobile will reach $10.4 billion in the US in 2020, a 40% increase over 2019. Mobile sales will be over $15 billion by 2023.